Liquidity Plus

Businesses often need short term finance to help manage periods of rapid growth. Our Liquidity Plus product can help you to release up to 100% of the value of your invoices, enabling you to access additional funding when you need it most.

What is Liquidity Plus?

Liquidity Plus is a product that can be bolted on to your invoice discounting facility when you need an immediate cash injection to your working capital*. This may be when you are facing unusually high customer demand during seasonal periods, need to invest in capital equipment or have a tax return due.

*Liquidity Plus is only available to Limited companies

How does Liquidity Plus work?

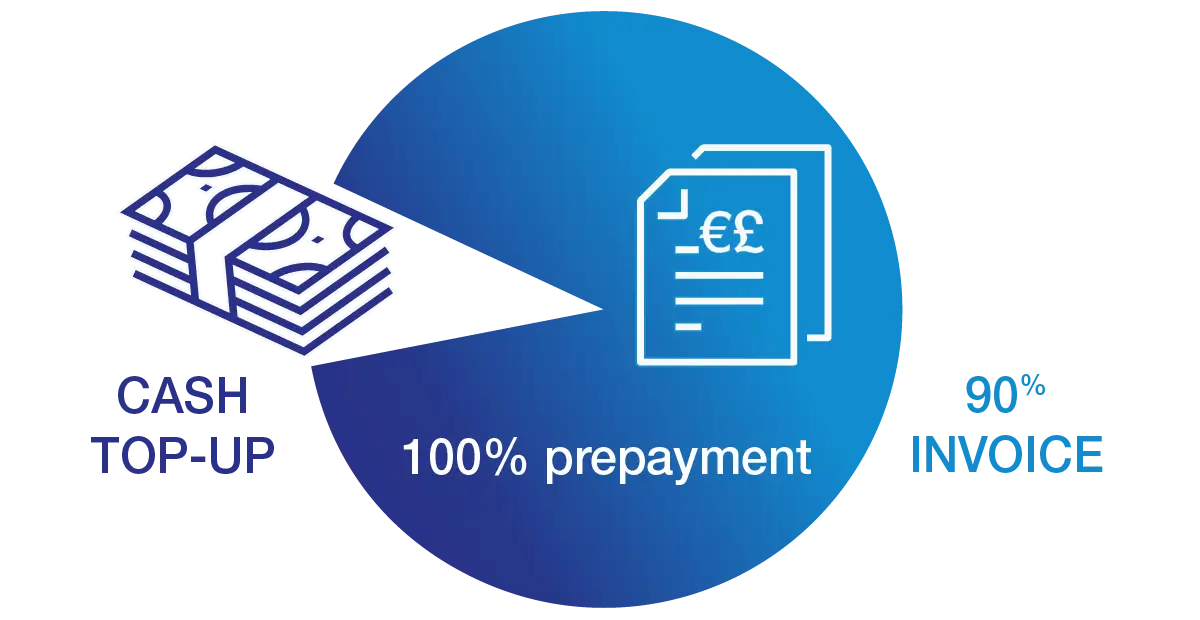

It essentially allows you to top-up your existing facility to up to 100% prepayment against the value of your invoices over an agreed short-to-medium term period. Liquidity Plus can be used as many times as required. It’s fast, simple and effective.

The benefits of Liquidity Plus are clear:

Flexibility to overcome peak cash flow demands and maximise growth.

An immediate injection of working capital.

Agreed terms, individually arranged to suit your business funding requirement.

Fast decision-making from professionals who understand your business.

100% prepayment has been brilliant and helped us start to accrue significant funds into our account, which will really help with our growth plans.

Shaun Bridgeman | Director Bridgeman Recruitment Services Ltd

How is Liquidity Plus helping our customers?

Liquidity Plus has helped Bridgeman Recruitment Services Ltd to gain 100% prepayment on their invoices, enabling recruitment of extra headcount, with room for further appointments in the near future to support expansion into a new industry.